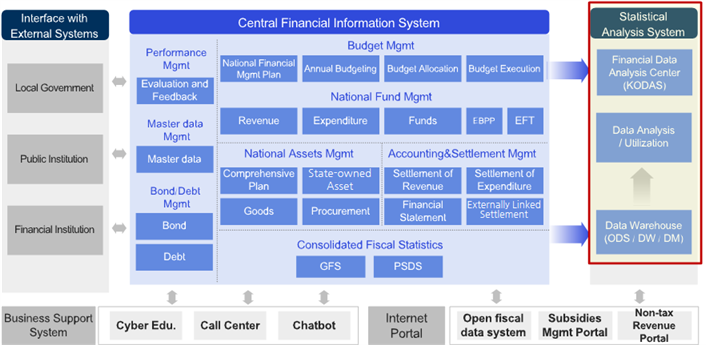

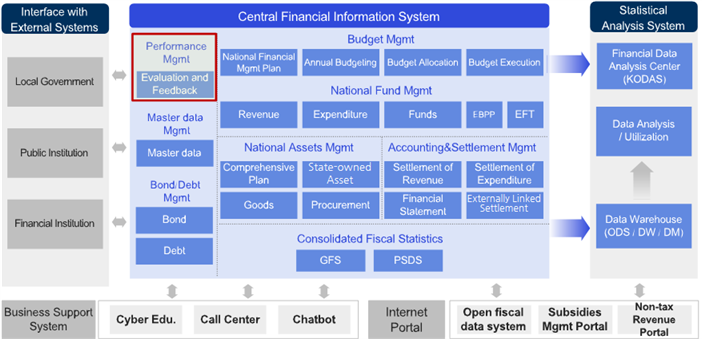

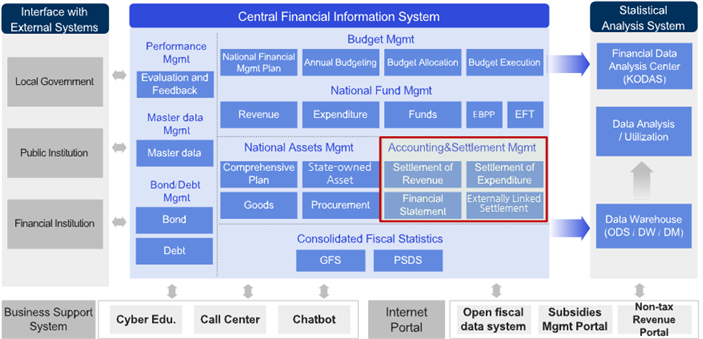

Introduction of dBrain System

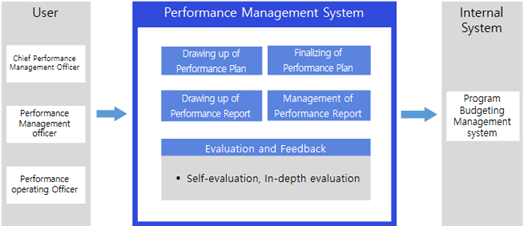

Performance Management

- Overview Financial performance and objective management is a practice of presetting each agency’s mission and strategic goals, goals of related programs, and indicators for measuring, confirming and inspecting whether the goals are reached, ultimately using the results in fiscal operation.

- Details

It can be set as part of a performance management program to reinforce circulation in budget formulation and execution and thereby implement performance planning and evaluation functions.

It can also provide self-evaluation and in-depth evaluation. Fiscal performance monitoring is enhanced to shift its focus to more performance and responsibility based management.

- Function

Performance planning (create plan → set evaluation indicators and measurement methods)

Fiscal operation (budget allocation and execution according to the performance plan)

Performance measurement and evaluation (create performance report announce evaluation result, and receive feedback)

- Feature

Manually managed items are converted to a database (DB) and the scope of DB conversion is expanded to other items such as unstructured data and items required for budget circulation.

The attribute data is coded by business classification such as evaluation result and post-evaluation corrective measures.

The scope of management is expanded by linking evaluation data to other institutions.

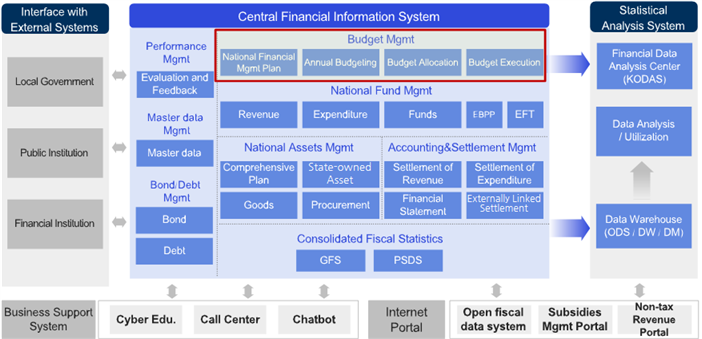

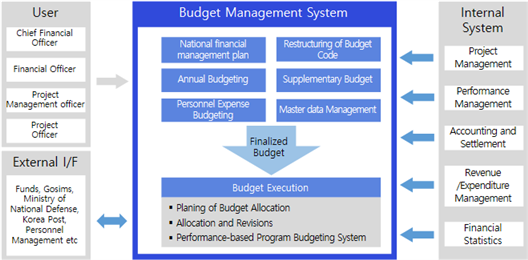

Budget Management

- Overview It establishes short and mid-to-long term plans for budget (general/special accounts) and funds and provides budget management throughout the entire processes of budget formulation and execution.

- Details

Efficient project management support system

Enhanced performance management function to support policy decisions.

Smart innovation of the entire budget process realizes the Go Paperless initiative.

- Function

Every budget-related task is performed within a single system, from budget formulation to execution.

The accumulation of data on budget allocation and formulation of previous fiscal years enables users to comprehend the budget flow from past to current fiscal year.

- Feature

Information usability is improved by setting up a detailed classification system of project type and creating a DB of standard property data.

The extraction and verification of similar or redundant projects are reinforced through a keyword search based on the basic property data of each project.

Screen display is integrated to show project-related information on a single page.

Display screens of similar types are integrated to simplify menu structure and enhance integrated management.

For new project registration, automatic setting of 12 or 16 industry areas for each field and department is provided.

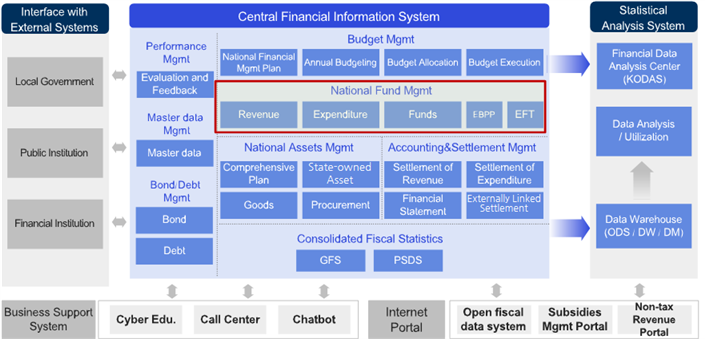

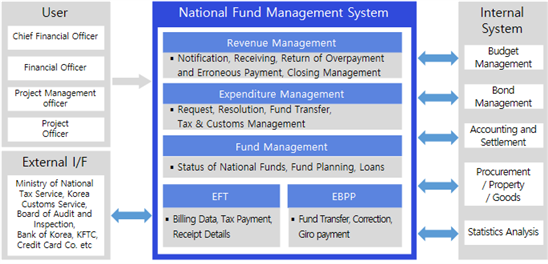

National Fund Management

- Overview It manages government revenues such as national taxes, customs duties, and penalty surcharges, executes expenditure from the national treasury in accordance with budgetary plans (general and special accounts) and fund management plans, and keeps records of and manages each of the entire expenditure processes.

- Details

Revenue: A project manager requests collection of revenue, a revenue collection officer approves the collection, and the payer who makes payment upon receipt of the bill processes receipt and settlement in connection with the Bank of Korea. A revenue collection officer closes each month and sends a certificate of account to the Board of Audit and Inspection.

Expenditure: An execution unit manager prepares a request to disburse upon confirmation of budget balance and requests an accounting officer for the act of expenditure. The accounting officer then verifies the act of expenditure, prepares and approves a document explaining the expenditure, and requests a disbursing officer to approve the expenditure. A disbursing officer approves the request and demands a transfer from the national treasury account to meet the request.

- Function

All information, including approval and request, is accessible in real-time.

All expenditure process is conducted through the systems in connection with Public Procurement Service, the Bank of Korea and the Korea Financial Telecommunications & Clearings Institute.

- Feature

Revenue: The function of installment payment is improved to be operable regardless of surcharge approval. (Payment in installments for the total amount collected, including surcharges, and history management of installment payments by sub-item of payment approval.)

Expenditure: The functions of requesting, asking for an act of expenditure, and approval are implemented in relation to government debt balance management, cost-effective government debt expenditure and cost-effective government debt.

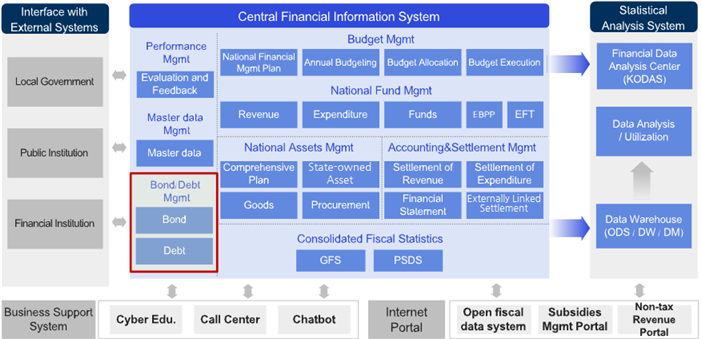

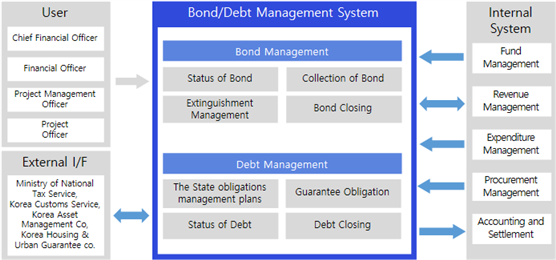

Bond & Debt Management

- Overview Bond: The bond management system oversees the overall process of generation and recollection of government bonds that are linked with the government’s revenue and expenditure. Debt: The debt management system identifies and manages the state of national debts.

- Details

Bond: The bond management system requests a revenue collection officer for notification and reminder of bond collection, performing the collection, change and extinguishment of bonds for each bond management office, and preparing and submitting all sorts of approval reports to a higher-level institution for closing.

Debt: The debt management system automates the processes of searching and reporting summary tables for each debt type for each fiscal year and accounting fund unit. It also prepares a range of settlement reports by creating national debt statements and verifying guarantee statements.

- Function

Bond: The bond management system provides a phased and systematic management of government bonds including collection, change, extinguishment, and closing of bonds in order to maintain the soundness of the national treasury and provide information on the state of treasury bonds.

Debt: The debt management system prepares a national debt management plan and produces and verifies debt data such as debt status and repayment plans to provide information on the status of national debt.

- Feature

A batch upload feature that shows the requests/results of property investigation and bond preservation results is provided.

A service to register the result of property investigation is provided with a single view.

It is asynchronous and does not influence connection duration, which prevents duplicated closing and errors, fundamentally increasing data credibility.

Domestic debt creation and repayment history for each debt are processed automatically and in synchronization.

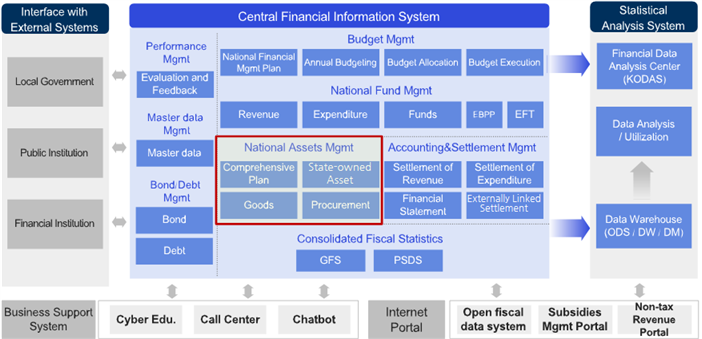

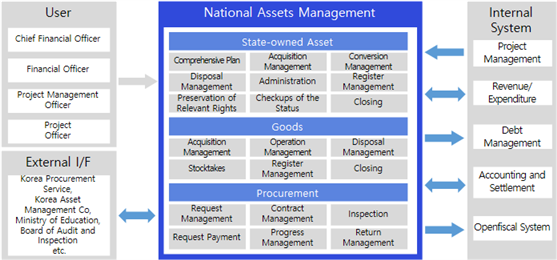

National Assets Management

- Overview It systematically manages the entire process regarding national asset, such as acquisition, use and disposition (sale, transfer, exchange and disuse) of all tangible and intangible assets owned for the purpose of state management.

- Details

State-owned Asset: A general administration office devises a general plan for the management of state-owned assets, such as the use, profit-making, lending, exchange, and transfer of all assets owned and managed by the state (administrative and general assets). A general administration office and each competent agency perform various tasks that occur in the management and disposal of state-owned assets, such as permission for use, loan contract, change of use, and abolition of use, through the system.

Goods Management: A goods management officer acquires public goods necessary for the purpose and use of government affairs or business in accordance with the Act on Contracts to Which the State is A Party, manages goods in use, and carries out procedures for disposal (sale or discard) of used goods.

Procurement Management: An accounting officer, a disbursing officer and a goods management officer of each government office conclude a contract for various procurements (e.g. goods, construction, and service contracts) for the purpose of state operation, handle the entire process of paying the contracting party through reviews and inspections using the system, and inquire and manage the status of acquired state assets.

- Function

State-owned Asset: More reliable data on state-owned assets is provided by using integrated and expanded sets of linked data (real estate/property data) to manage assets systematically in accordance with the general plan for state-owned assets, from acquisition to disposal of state-owned assets.

Goods Management: Up-to-date information on the acquisition and use of public goods is provided for the management of the entire process of public goods including disposal of used goods.

Procurement Management: The entire process from contract closing to payment of national procurement for goods and services is systematized. Previously constructed (existing) acquired assets or goods are registered to the asset registry and managed therein.

- Feature

State-owned Asset: There is a monthly linkage with the building energy system to collect electricity and gas consumption information. While this real-time linkage enables fast processing of tasks, integration of similar functions and database and a 3D building shape inquiry enable a more realistic state-owned asset management.

Goods Management: Assets are automatically numbered by asset type to improve accounting accuracy and efficiency.

Procurement Management: Information regarding private investment projects is provided in linkage with the system.

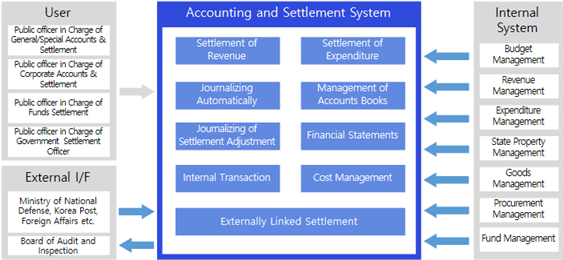

Accounting and Settlement Management

- Overview It processes every accounting transaction in real-time and supports accounting and financial settlement reporting in compliance with international standards of accrual/cash basis of accounting.

- Details

Budget Settlement: The national settlement requires a systematic preparation of the government’s financial operation result, financial status, and financial operation performance for each settlement unit. The budget settlement is a task of producing data required for tax revenue and expenditure (revenue and expenditure) after the closing of total revenues and expenditures for the fiscal year out of the data prepared during the process of national settlement and preparing a report on revenue and expenditure (revenue and expenditure) for each fund, central government and combined governments.

Financial Settlement: Financial settlement is a task of writing and submitting financial settlement reports according to the settlement procedure and reporting protocol of the national settlement report.

Externally Linked Settlement: The externally linked settlement enables budget settlement and financial settlement by using externally linked systems, rather than the dBrain system, and confirms the results transmitted through system linkage. For an unlinked institution, users can access dBrain to prepare a settlement report directly.

- Function

Preparation of overall financial statements including ledger management and intercompany transaction elimination.

Creation, modification, issuance and confirmation of financial settlement reports.

In case of intercompany transactions, the data acquired in linkage with externally linked systems is used to confirm the results. For an unlinked institution, a screen for writing a report is provided.

- Feature

Journal entry automation in compliance with international accounting standards has improved accounting accuracy. Enhanced user-friendliness enables all users to navigate the system easily, even without accounting knowledge.

Automatic statement creation, general ledger management, financial statement, supplemental schedules, etc.

Creation of financial statement > modification of financial statement > fund summarization and financial statement analysis > settlement report and audit report > confirmation of financial settlement

Externally Linked Settlement: Dedicated screen pages are provided for ledger, items subject to intercompany transaction elimination, financial settlement report, and financial settlement confirmation.

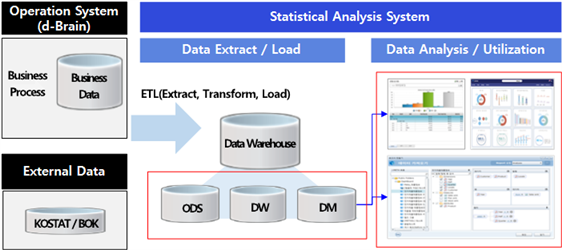

Statistical Analysis System

- Overview It is a system that supports prompt decision-making process by collecting external data in linkage with central government data and data from local governments, the Bank of Korea, Statistics Korea, and private institutions, and forming financial statistics (structured and unstructured), and EIS.

- Details

It helps users easily identify nation's fiscal status and use such information to develop fiscal policy by providing various analyses of government financial information such as budget and settlement.

It extracts and aggregates the information generated in the digital budget accounting system dBrain according to analysis characteristics to load them into the data storage and provides an analysis environment where users can perform various statistical analyses of the stored data for desired analysis purposes.

- Function

It is a system provided for the purpose of analysis, not for task processing. It derives analysis results for decision-making.

Users may use the ETL feature to extract, transform and load company (work) data and external data, both of which are subject to analysis, and use for data analysis.

- Feature

Data warehouse: It is a database that converts and manages accumulated data in the database of the backbone system to help the user make a better decision.

An acronym for extract, transform and load, ETL is a feature for combining multiple systems into a single database to build data warehouse in the information account.